EOT Faqs

1. I’ve heard a few different names for this type of trust. What is it called?

- Employee Ownership Trust (EOT)

- Perpetual Trust

- Perpetual Purpose Trust (PPT)

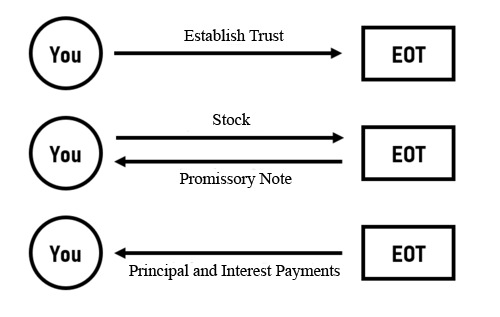

2. How does the transaction work?

Just as with an ESOP, the selling owner establishes a trust and the corporation redeems their stock. Typically, the selling owner will take a promissory note with principal and interest payments over a period of years.

3. Are there any tax benefits for EOTs?

There are bills in Maryland and Wisconsin. These bills would provide a state capital gains exemption on sales to EOTs and ESOPs.

4. Does it have to be perpetual? What if I expect a future sale?

An EOT does not need to be perpetual. As the trustor, you can (and should) specify the precise conditions under which a sale would be permitted. Sale proceeds will be distributed as provided in the trust document (e.g., to the employee-owners or charity).

5. What about governance?

In most cases, governance will be the same as an ESOP (i.e., a “circular” structure where the board appoints the trustee and the trustee appoints the board). However, if so motivated, the founder can also provide for limited or full voting rights, similar to a cooperative.

6. What is the financial benefit to employees? What about retirement?

An EOT-owned company shares a portion of its profits (or gains) with employees. These distributions are typically paid out at the corporate level in the form of cash bonuses or 401(k) contributions, and are therefore tax-deductible.

7. Do I need special trust law in my state?

No, you do not need special trust law in your state. That said, your state may or may not offer adequate trust law. However, an “administrative trustee” can be hired from another state for less than the cost of an ESOP trustee. The advantage here is that your corporate domicile remains the same.

8. Can I include other beneficiaries in my EOT?

Yes, that is a great place to start a discussion about installing an EOT or EOT alternative.

9. Is the EOT regulated by the Department of Labor (under ERISA)?

No, an EOT is not a retirement plan and is therefore not regulated under ERISA. The EOT is regulated under state trust law, which generally respects the wishes of the trustor (i.e., you).

10. Is it expensive to create an EOT?

EOT implementation costs are a fraction of the expense of an ESOP. Annual costs are virtually negligible compared to ESOP maintenance costs. Of course, EOTs are also less expensive than the typical M&A advisory fees on a sale to a third party.